Now that Driller has won that particular debate, I’d be interested in any Brexiteers thoughts on today’s inflation figures and the consequent likely rise in interest rates.

Project Fear or Taking back control?

Actually Driller didn't win it. The money was raised in the bond markets, but the bonds were bought by the European Central Bank, not by Italy's central bank. The ECB has rules about how much sovereign debt it is allowed to buy from its member countries. In Italy's case it broke those rules to 'over buy' it's bonds. Without the intervention of the ECB Italy would not have been able to service it's debt. Since the ECB is the monetary arm of the EU it is in effect an EU bailout.

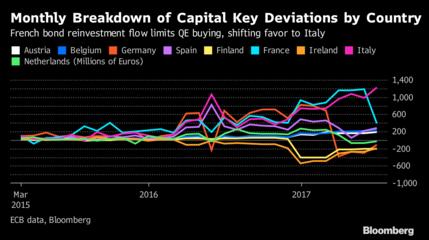

Thank you....and here is the Bloomberg chart showing those purchases....heavily in favour of Italy

Quote: The ECB bought 1.2 billion euros more Italian debt in July than it should have under its capital key, a GDP-based benchmark of how much it can hold for each country, according to data released this week. That’s the largest deviation from the key since the program started in March 2015. It purchased just 384 million euros more French debt than it should have, compared with a 1.19 billion-euro overshoot in June.

“The clear winner is Italy”, said Andrew Roberts, the head of European macro research at NatWest Markets in London. “This represents a vary major support for BTPs.”

https://www.bloomberg.com/news/artic...s-bonds-mature

Last edited by tarquinbeech; 17-10-2017 at 01:13 PM.

Italy's central bank sits on the board of the ECB and does little else now. Italy's central bank can't emit euros, so has no influence on monetary policy. The ECB is effectively the central bank for all eurozone countries, including Italy. If you say that I used the wrong term I'm willing to concede that point, but the overall principle stands.

Salmagundi I'll ask you this question as Tarkers has repeatedly avoided it. The ECB has bought a fantastic amount of German bonds. The Fed has bought 5 trillion dollars of US bonds. The Bank of England has bought half a trillion pounds of UK bonds. Can you explain to me why that is sensible monetary policy, central banks working in cooperation with governments, but in Italy's case it's a bailout?

Edit to add that the Bank of Italy does still buy Italian bonds, I actually didn't realise that myself so I can't criticise you, but it does mean that your second sentence is wrong.

Last edited by drillerpie; 17-10-2017 at 01:37 PM.

Why do you keep trying to include France, UK, USA into the argument?.....you tell me NOT to include a hypothetical situation of a bank loaning a household money, to balance it's books....and tells the household NOT to gamble it on 365.....but you wander from the topic regularly.

I have no idea what France is doing with it's "overshoot" of QE stimulus.....my guess is that Macron will use the money to ease voters fears over his new policies and keep the rioters off the streets.....it's all politics at the end of the day.

The EU, via the ECB decided to pump "free money" into the coffers of EURO-using countries.....60 billion per month

Germany, as the main economic driver of the EU, insisted on rules that the money should be used in proportion to the size of each economy.....ie everyone got a fair slice of the "free" pie.

The ECB is breaking those rules by buying too much Italian debt......THEN.....to compound the rule-breaking, the Italians bailed-out their own banks to avoid high-street investors losing money and voting accordingly.

The whole thing stinks and I'm glad we're getting out